Treasury

Reporting covers fiscal policy, taxation, funding schemes, and economic measures introduced or influenced by HM Treasury that directly affect UK hospitality and foodservice businesses. Coverage includes Budget announcements, VAT and duty changes, business rates policy, and support schemes, offering essential context and guidance for operators navigating the financial and regulatory landscape.

-

Jul- 2023 -3 JulyBreweries and Distilleries

Gov to launch new Alcohol Duty rates and reliefs

HM Revenues and Customs (HMRC) has announced that on 1 August 2023, the Alcohol Duty system will become much “simpler”, taxing all alcoholic drinks based on their alcohol by volume (ABV). The new Alcohol Duty system will replace the current Alcohol Duty system, which consists of four separate taxes covering…

Read More » -

Jun- 2023 -14 JuneTrade Associations

Hospitality can deliver £29bn economic boost with right support, says UKH

In the past six years hospitality has increased its annual economic contribution by £20bn to £93bn, according to a new report launched at UKHospitality’s summer conference. It also showed that employment in the sector has risen to 3.5m, making hospitality the third largest employer in the country. The report, produced…

Read More » -

Mar- 2023 -15 MarchNews

Spring Budget: Corporation tax to rise to 25%

Corporation tax is set to rise from 19% to 25% for firms with profits over £250,000, as part of a number of measures announced in chancellor Jeremy Hunt’s Spring Budget. To help offset the corporation tax rise, Hunt also announced a provision of £9bn of “full capital expensing” which for…

Read More » -

Dec- 2022 -20 DecemberGovernment

Gov confirms alcohol duty freeze extension

The government has announced that the freeze on alcohol duty has been extended for a further six months to 1 August 2023. In a statement to the House of Commons, Exchequer Secretary to the Treasury James Cartlidge laid out a plan aiming to give certainty to people in the catering…

Read More » -

Oct- 2022 -26 OctoberBusiness

HospoDemo to stage third protest as it urges gov to prevent closures

The hospitality industry is set to stage its third protest next month at Parliament Square, urging the government to make policy changes to prevent “catastrophic closures” within the sector. The protest will be held at 11am on Monday 14 November, with members of the hospitality industry invited to converge on…

Read More » -

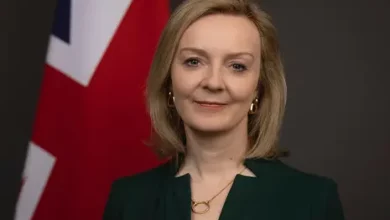

20 OctoberGovernment

Liz Truss steps down as prime minister

Liz Truss has announced that she is standing as prime minister after a turbulent week for the government, just six weeks after taking up the premiership. The statement of her resignation was made at 13:30pm today (20 October) following a meeting between Truss and Sir Graham Brady, chairman of the…

Read More » -

17 OctoberGovernment

Chancellor reverses almost all mini-budget tax cuts

Newly appointed chancellor Jeremy Hunt has reversed almost all of the mini-budget commitments made by previous chancellor Kwasi Kwarteng last month, in a statement made at the Treasury today (17 October). He confirmed the basic rate of income tax will remain at 20% “indefinitely” until the economic situation stabilises, marking…

Read More » -

Sep- 2022 -23 SeptemberNews

Chancellor announces sweeping tax cuts in first mini-budget

Chancellor Kwasi Kwarteng has today (23 September) announced a ream of tax cuts alongside a £60bn energy support package as part of the new government’s first mini-budget. Setting out his aims for economic growth, Kwarteng said that he wants the economy to increase by 2.5% annually in the medium-term, through…

Read More » -

Mar- 2022 -18 MarchAnalysis

13 Spring Statement predictions

With both the global and UK economies coming under pressure from the rising cost of living crisis, which has only been exacerbated by Russia’s invasion of Ukraine, all eyes will be on the chancellor when he makes his Spring Statement speech on 23 March 2022. Here, Christy Wilson, tax associate…

Read More » -

Feb- 2022 -8 FebruaryGovernment

Over 250 hospitality leaders call for VAT to be held at 12.5%

More than 250 business leaders from hospitality and leisure have written to the chancellor, Rishi Sunak, urging the Government to keep VAT at 12.5% beyond March 2022, according to UKHospitality. It revealed the letter calls on the Treasury to maintain the current level to enable many “fragile” businesses to continue…

Read More »