Private equity

Reporting centres on investment activity across the UK hospitality and foodservice sector, with analysis of buyouts, growth capital, and ownership changes involving restaurant groups, pub companies, and catering operators. Coverage includes deal flow, fund strategy, portfolio performance, and investor outlook, offering valuable intelligence for senior executives, founders, and stakeholders navigating funding, expansion, and exit planning.

-

Jan- 2024 -12 JanuaryPubs and Bars

Corporate buyers return to pub market in 2023

Tenanted pub companies made up 23% of freehold buyers in 2023, compared with 12% in 2022, according to data from Christie and Co. Furthermore, Christie and Co’s pub price index dropped 8.1% for 2023 as a result of interest rate hikes and a stubborn inflationary environment during 2023. Activity was…

Read More » -

12 JanuaryRestaurants

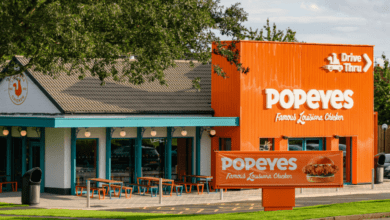

TDR secures majority stake in Popeyes UK

Private equity firm TDR Capital has secured a majority stake in Popeyes UK following a subsequent investment. The news comes after TDR made a £50m investment in Popeyes last year and has since raised its ownership to effectively overtake dual partner Ring International Holdings, who hold a minor stake. The…

Read More » -

Nov- 2023 -28 NovemberNews

TRG shareholders approve £506m Apollo deal

The Restaurant Group shareholders have formally voted in favour of the company sale to US-based private equity company Apollo Global Management for £506m. During a general meeting held yesterday (27 November), 93.5% of shareholders voted in favour of the cash acquisition of the group, which includes Wagamama and the pub…

Read More » -

Sep- 2023 -22 SeptemberRestaurants

Yolk raises capital for London expansion

Fine fast food business Yolk is raising capital through private equity firm Growthdeck as it targets expansion across London. The five-site independent offers sandwiches, baked goods and specialty coffee without charging consumers a premium price tag. Yolk said that the brand aims to offer a “revolutionary improvement” in Londoners’ grab-and-go…

Read More » -

8 SeptemberCatering Companies

Food and beverage sector sees rise in M&A activity

Food and beverage M&A activity has increased 13% in Q2 2023, after welcoming signs of recovery at the start of 2023, according to new research from Grant Thornton UK LLP. The firm’s analysis has found that 42 deals were recorded in Q2 2023, as deal volumes rose for the third…

Read More » -

Aug- 2023 -25 AugustBusiness

Subway sold to Roark Capital

Subway has announced that it has entered into a definitive agreement to be acquired by affiliates of private equity firm Roark Capital for an undisclosed sum. The company has branded this is a “major milestone” in the company’s transformation journey, combining Subway’s global presence and brand strength with Roark’s deep…

Read More » -

Jun- 2023 -20 JuneNews

Hostmore appoints new non-executive director

Hospitality group Hostmore has today announced the appointment of Célia Pronto as an independent non-executive director with immediate effect. Pronto has over 25 years of experience in blue chip listed companies, private equity and venture capital backed start-ups and family-owned businesses. She has worked in subscription model businesses, as well…

Read More » -

May- 2023 -18 MayNews

Social Pantry appoints new non-executive chairman

Social Pantry, a leading sustainable events and workplace caterer, has recently announced the appointment of James Spragg as new non-executive chairman. Spragg will work closely with CEO and founder, Alex Head, to accelerate the growth of the business, whilst maintaining its core values across sustainability and ex-offender hiring. He joins…

Read More » -

Jan- 2023 -31 JanuaryRestaurants

TriSpan acquires stake in Mowgli

TriSpan, a global private equity firm, has acquired a stake in Mowgli, a leading Indian casual dining restaurant group, after it invested through its dedicated restaurant fund Rising Stars. Nisha Katona MBE, founder of Mowgli, will continue to lead the group as CEO in its next phase of growth, supported…

Read More » -

26 JanuaryPeople

Hostmore chairman to step down

Hostmore has announced that its chairman and non-executive director, Gavin Manson, will be retiring at the end of the annual general meeting on 25 May 2023 to focus on his other executive commitments. As a result, the board has appointed Stephen Welker, a current non-executive director, has agreed to become…

Read More »