The UK foodservice and restaurant sector enters 2025 at a moment of structural reckoning. After years of disruption driven by the pandemic, inflation, labour shortages and shifting consumer behaviour, headline revenues have recovered to record levels, yet profitability remains under sustained pressure.

This report provides a detailed strategic assessment of a £57bn market undergoing rapid consolidation and polarisation, where scale, capital strength and brand clarity increasingly determine success.

1. Executive summary

The United Kingdom’s foodservice and restaurant sector currently stands at a critical strategic juncture, defined by a “profitless prosperity” paradox where top-line revenues have reached historic highs while operating margins remain under sustained siege. As the industry moves through 2025, the overarching narrative is one of structural recalibration following the seismic shocks of the 2020-2023 period.

This report provides an exhaustive, investor-grade analysis of the UK market, anchored by a ranked assessment of the Top 50 foodservice businesses by revenue. The aggregate turnover of this cohort now exceeds £35 billion, highlighting the intense concentration of market power among a select group of “super-operators” who have successfully leveraged scale to mitigate inflationary headwinds.

1.1 The macroeconomic context

While the double-digit inflation of previous years has abated, the sector operates within a permanently elevated cost environment. The primary pressure points identified in this analysis include:

-

Labour economics: The cumulative effect of National Living Wage (NLW) increases has fundamentally altered the P&L structure of hospitality businesses. With the NLW rising significantly since 2020, labour-intensive models are being forced to automate or premiumise.

-

Supply chain volatility: Although headline food inflation has softened, specific categories crucial to the sector—such as coffee, cocoa, and olive oil—remain volatile due to geopolitical instability and climate-related yield reductions.

-

Insolvency landscape: Despite the resilience of the Top 50, the wider market remains fragile. Insolvencies in the accommodation and food services sector, while down 11% year-on-year in early 2025, remain historically high, with 3,405 businesses failing in the 12 months to February 2025. This “clearing of the decks” is removing excess capacity and allowing stronger, capital-rich operators to acquire sites at favourable premiums.

1.2 Strategic bifurcation

A distinct polarization has emerged in the competitive landscape:

-

The flight to value and convenience: The Quick Service Restaurant (QSR) and bakery sectors, led by Greggs, McDonald’s, and Wingstop, are aggressively capturing market share. Consumers, facing squeezed disposable incomes, are trading down from casual dining to high-quality fast food, driving a “baker-to-go” boom.

-

The flight to experience: Conversely, the premium casual and experiential dining segments—exemplified by The Ivy Collection, Dishoom, and Hawksmoor—are performing exceptionally well. Consumers are protecting their spend for special occasions, prioritizing brands that deliver high-engagement experiences over generic mid-market offerings.

2. The UK top 50 foodservice businesses

The following table ranks the 50 largest foodservice and restaurant operators registered in the UK by their most recent full-year turnover.

| Rank | Company / Group Name | Primary Sector | Key Brands | Latest FY Revenue (£) | FY End Date | EBITDA / Op. Profit (£) | Ownership |

| 1 | Compass Group UK & Ireland | Contract Catering | Chartwells, Eurest, Levy, ESS | £2.20bn+ (Est.) | Sep 2024 | N/A (Group) | Public (LSE: CPG) |

| 2 | Mitchells & Butlers plc | Pubs & Restaurants | Harvester, All Bar One, Miller & Carter | £2.61bn | Sep 2024 | £312m (Op Profit) | Public (LSE: MAB) |

| 3 | Greggs plc | Bakery / QSR | Greggs | £2.52bn | Dec 2024 | £167.7m (Pre-tax) | Public (LSE: GRG) |

| 4 | Greene King Limited | Pubs & Brewing | Greene King, Chef & Brewer, Hungry Horse | £2.45bn | Dec 2024 | £198m (Adj. Op Profit) | CK Asset Holdings |

| 5 | JD Wetherspoon plc | Managed Pubs | Wetherspoons, Lloyds No.1 | £2.13bn | Jul 2025 | £146.4m (Op Profit) | Public (LSE: JDW) |

| 6 | Stonegate Pub Company | Pubs & Bars | Slug & Lettuce, Be At One, Craft Union | £1.72bn | Sep 2024 | £442m (EBITDA) | TDR Capital |

| 7 | McDonald’s Restaurants Ltd | QSR | McDonald’s | ~£1.60bn (Corp) | Dec 2023 | £11m (Op Profit) | McDonald’s Corp |

| 8 | Costa Limited | Coffee | Costa Coffee | £1.23bn | Dec 2024 | (£13.5m) (Loss) | Coca-Cola |

| 9 | Pret A Manger (Europe) Ltd | Food-on-the-Go | Pret A Manger | £1.20bn (Global) | Jan 2025 | £98m (Adj EBITDA) | JAB Holdings / Founders |

| 10 | Sodexo Limited | Contract Catering | Sodexo, The Good Eating Company | ~£1.10bn (Est.) | Aug 2024 | N/A | Public (Sodexo SA) |

| 11 | Marston’s PLC | Managed Pubs | Marston’s, Pitcher & Piano | £898.6m | Sep 2024 | £192.5m (EBITDA) | Public (LSE: MARS) |

| 12 | Westbury Street Holdings (WSH) | Contract Catering | BaxterStorey, Benugo, Searcys | >£850m (Est.) | Dec 2023 | £43.2m (PBT – BS) | CD&R / WSH |

| 13 | Whitbread PLC (F&B) | Pub Restaurants | Beefeater, Bar + Block, Brewers Fayre | £673.1m | Feb 2025 | N/A (Divisional) | Public (LSE: WTB) |

| 14 | Domino’s Pizza Group plc | QSR / Delivery | Domino’s | £664.5m | Dec 2024 | £107.3m (Underlying PBT) | Public (LSE: DOM) |

| 15 | Starbucks Coffee Company (UK) | Coffee | Starbucks | £547.7m | Oct 2023 | £21.7m (Op Profit) | Starbucks Corp |

| 16 | Young & Co.’s Brewery, P.L.C. | Managed Pubs | Young’s, City Pub Group | £485.8m | Mar 2025 | £113.6m (Adj EBITDA) | Public (AIM: YNGA) |

| 17 | PizzaExpress Group | Casual Dining | PizzaExpress | £442.1m | Dec 2023 | £4.3m (Adj PBT) | Wheel Topco (Debt Holders) |

| 18 | Fuller, Smith & Turner P.L.C. | Pubs & Hotels | Fuller’s, Bel & The Dragon | £359.1m | Mar 2024 | £60.8m (Adj EBITDA) | Public (LSE: FSTA) |

| 19 | Loungers plc | Casual Dining | The Lounge, Cosy Club, Brightside | £353.5m | Apr 2024 | £59.6m (Adj EBITDA) | Public (AIM: LGRS) |

| 20 | Punch Pubs & Co | Pubs | Punch Pubs | £324.3m | Aug 2024 | £95.8m (EBITDA) | Fortress Investment Group |

| 21 | Five Guys JV Limited | Fast Casual | Five Guys | £320.8m | Dec 2023 | £41.2m (EBITDA+PO) | JV (Murrell Family/Dunstone) |

| 22 | The Big Table Group | Casual Dining | Las Iguanas, Bella Italia, Banana Tree | £316.7m | Oct 2024 | £13.9m (EBITDA) | Epiris |

| 23 | The Ivy Collection (Troia UK) | Premium Casual | The Ivy Brasserie, The Ivy Asia | £314.7m | Dec 2023 | £57.5m (Adj EBITDA) | Richard Caring |

| 24 | Azzurri Group | Casual Dining | Zizzi, ASK Italian, Coco di Mama | £303.1m | Jun 2025 | £30.2m (Adj EBITDA) | TowerBrook Capital |

| 25 | St Austell Brewery | Pubs & Brewing | St Austell, Tribute, Bath Ales | £231.0m | Dec 2024 | £22.4m (EBITDA) | Family Owned |

| 26 | Hollywood Bowl Group plc | Leisure Dining | Hollywood Bowl, Puttstars | £230.4m | Sep 2024 | £87.6m (Adj EBITDA) | Public (LSE: BOWL) |

| 27 | Gail’s (Grain Topco) | Bakery / Café | Gail’s Bakery | £219.8m | Feb 2025 | £53.6m (Adj EBITDA) | Bain Capital / Management |

| 28 | Admiral Taverns | Leased Pubs | Community Pubs | £194.5m | May 2024 | £59.7m (Underlying Profit) | Proprium Capital Partners |

| 29 | Hostmore plc (TGI Fridays) | Casual Dining | TGI Fridays (Note: Administration 2024) | £190.7m | Dec 2023 | £22.2m (EBITDA) | Public (Delisted/Asset Sale) |

| 30 | Shepherd Neame | Pubs & Brewing | Spitfire, Bishops Finger | £172.3m | Jun 2024 | £25.1m (Underlying EBITDA) | Public (Aquis: SHEP) |

| 31 | Itsu Limited | QSR / Grocery | Itsu | £160.7m | Dec 2023 | £8.1m (EBITDA) | Private (Julian Metcalfe) |

| 32 | Wingstop UK | QSR | Wingstop | £160m+ (Run Rate) | Dec 2024* | £13.7m (9mo Op Profit) | Sixth Street |

| 33 | Cote Restaurants | Casual Dining | Cote | >£151.7m | Sep 2024 | (£5.5m) (EBITDA Loss) | Karali Group (Acq. 2024) |

| 34 | The Revel Collective (Revolution) | Bars | Revolution, Peach Pubs | £149.5m | Jun 2024 | £3.0m (Adj EBITDA) | Public (AIM: TRC) |

| 35 | Dishoom | Casual Dining | Dishoom | £137.1m | Dec 2023 | £18.6m (Adj EBITDA) | Private / L Catterton |

| 36 | Ten Entertainment Group | Leisure | Tenpin | £126.7m | Dec 2022 | £39.6m (Adj EBITDA) | NEGM (Private Equity) |

| 37 | Hall & Woodhouse | Pubs & Brewing | Badger Beers | £122.0m | Jan 2025 | £8.1m (Underlying PBT) | Family Owned |

| 38 | Wasabi Co. Ltd | QSR | Wasabi | £121.6m | Dec 2024 | £2.2m (Pre-tax Profit) | Capdesia |

| 39 | Daniel Thwaites PLC | Pubs & Hotels | Thwaites, House of Daniel Thwaites | £120.6m | Mar 2024 | £12.2m (Op Profit) | Public (Aquis: THW) |

| 40 | Amber Taverns | Pubs | Amber Taverns | £119.9m | Feb 2025 | £19.1m (Pre-tax Profit) | Epiris |

| 41 | Hawksmoor (Underdog) | Premium Dining | Hawksmoor | £100.3m | Dec 2023 | £9.1m (EBITDA) | Private (Graphite Capital) |

| 42 | Robinsons Brewery | Pubs & Brewing | Robinsons, Trooper | £97.7m | Dec 2023 | £6.2m (Op Profit) | Family Owned |

| 43 | JW Lees | Pubs & Brewing | JW Lees | £95.8m | Mar 2024 | £7.1m (Pre-tax Profit) | Family Owned |

| 44 | Mission Mars | Casual / Bars | Albert’s Schloss, Rudy’s Pizza | £92.9m | Sep 2024 | £8.7m (Adj EBITDA FY23) | BGF / Private |

| 45 | Bill’s Restaurants | Casual Dining | Bill’s | ~£90.6m (Est) | Dec 2023 | £2.45m (H1 EBITDA) | Richard Caring |

| 46 | Joe & The Juice UK | Café | Joe & The Juice | £77.0m | Dec 2023 | £5.0m (Profit) | General Atlantic |

| 47 | San Carlo Group | Premium Dining | San Carlo, Cicchetti | £76.9m | Sep 2023 | £2.7m (Pre-tax Profit) | Family Owned |

| 48 | Individual Restaurants | Casual Dining | Piccolino, Riva Blu | £76.0m | Mar 2024 | N/A | Iceland Foods (Walker Family) |

| 49 | Rare Restaurants | Premium Dining | Gaucho, M Restaurants | £75.0m | Dec 2023 | £9.1m (EBITDA) | SC Lowy / Investec |

| 50 | JKS Restaurants | Diverse / Fine | Gymkhana, Hoppers, BAO | £73.0m | Mar 2024 | £8.6m (Adj EBITDA) | Private (Sethi Family) |

3. Market overview: Sector dynamics

The UK foodservice market is a complex ecosystem valued at approximately £57 billion, forecast to grow at a CAGR of 6.7% through 2029. This growth, however, is not evenly distributed. The market is fragmenting into distinct performance tiers based on operational model and consumer proposition.

3.1 Contract catering: The quiet giants

The contract catering sector remains the financial backbone of the industry, dominated by the “Big Three”: Compass Group, Sodexo, and Westbury Street Holdings (WSH). This segment has shown remarkable resilience, adapting to the hybrid working revolution by reinventing the workplace canteen as a “destination dining” experience to lure employees back to the office.

Data from the Contract Catering Tracker reveals that the top operators grew sales by 12% year-on-year in Q4 2024, continuing a streak of double-digit growth. This resurgence is driven not just by volume but by a structural shift towards higher-quality, subsidised food offers as corporate clients use catering as an employee retention tool. Furthermore, consolidation is rampant; Compass Group’s £475 million acquisition of CH&Co in 2024 has created a behemoth with unparalleled buying power, effectively raising the barriers to entry for mid-sized competitors.

3.2 The pub sector: Managed vs. leased

The dichotomy between managed and leased/tenanted pub models has never been starker.

-

Managed estates: Groups like Mitchells & Butlers and Young’s control every aspect of the guest experience, allowing them to implement price increases and menu engineering swiftly. They are currently benefiting from a “capex super-cycle,” investing heavily in refurbishments to premiumise their estates.

-

Leased & Tenanted (L&T): Companies like Admiral Taverns and the tenanted divisions of Star Pubs (Heineken) operate a property-focused model. While this offers more stable rental income, the underlying tenants are heavily exposed to utility and wage shocks. To mitigate this, operators like Punch Pubs and Greene King are aggressively expanding “franchise” or “management partnership” models (e.g., the Hive concept), which hybridize the two approaches to share risk and reward more equitably.

3.3 The rise of QSR and “Fast Casual 2.0”

The Quick Service Restaurant sector is evolving into “Fast Casual 2.0.” The dominance of legacy burger brands is being challenged by a new wave of specialized, high-quality fast food.

-

Chicken is King: The explosive growth of Wingstop (reporting 70% sales growth) and Popeyes indicates a shift in consumer preference towards premium fried chicken. These brands command higher price points than traditional fast food but offer a perceived quality upgrade that resonates with Gen Z.

-

Bakery Dominance: Greggs has effectively conquered the breakfast and lunch dayparts, putting immense pressure on coffee chains and supermarkets. Their strategy of extending opening hours into the evening has unlocked a new revenue stream previously dominated by takeaway delivery platforms.

4. Select company profiles

This section highlights key strategic moves for select companies from the Top 50, illustrating broader market trends.

Compass Group UK & Ireland (Rank 1) Compass Group is the undisputed heavyweight of the sector. Its strategy is defined by “sectorisation”—creating bespoke brands for specific verticals like education (Chartwells) and sports (Levy). In 2024, Compass cemented its dominance with the £475m acquisition of rival CH&Co , a move that integrated a massive portfolio of premium B&I contracts. The group is also pioneering the use of “frictionless” stores in hospitals and defense sites, leveraging AI to reduce labour costs.

Greggs plc (Rank 3)

Under the leadership of Roisin Currie, Greggs has transitioned from a high street baker to a formidable food-on-the-go operator. Its strategic pillars—extending trading hours into the evening, expanding the digital loyalty app, and aggressively opening drive-thru sites—have insulated it from high street footfall declines. The brand’s value proposition is unmatched; it has managed to pass on inflation costs without alienating its core demographic.

JD Wetherspoon plc (Rank 5) Chairman Tim Martin’s relentless focus on price leadership has paid dividends in an inflationary environment. By divesting smaller, lower-margin pubs, Wetherspoon has optimized its estate, focusing on larger “super-pubs” with high volume capabilities. The company is a massive tax contributor, generating £838m in taxes in 2024 alone. The brand has successfully attracted younger demographics with cheap coffee and diverse craft beer options.

Stonegate Pub Company (Rank 6) As the UK’s largest pub company by site count (following the acquisition of Ei Group), Stonegate operates a dual model of managed and leased sites. Its managed division has struggled with the downturn in late-night spending, but its Craft Union operator-led model has been a standout performer, revitalizing wet-led community pubs. The group is navigating a complex debt restructuring process, with reports of potential asset sales to service its debt pile.

Pret A Manger (Rank 9) Pret has successfully navigated its “post-pandemic” existential crisis. No longer solely reliant on London office workers, it has expanded into regional towns and suburbs. Its subscription model (“Club Pret”) was a pioneering loyalty play, though recently modified to protect margins. The company is now pursuing a dual strategy of UK regional growth and aggressive international expansion (India, US), backed by owners JAB Holdings.

Westbury Street Holdings (Rank 12) WSH is the premium powerhouse of contract catering. Its flagship brand, BaxterStorey, reported record revenues of £637.5m in 2023, capitalizing on the “flight to quality” in corporate dining. As firms try to lure staff back to offices, they are upgrading catering to restaurant standards—a trend WSH dominates. The group also operates high-street facing brands like Benugo, providing a diversified revenue stream.

Loungers plc (Rank 19) Loungers is arguably the most successful rollout story of the decade. It opens roughly 30 new sites a year, targeting suburbs and market towns that other operators ignore. Its “all-day” model maximizes asset utilization from breakfast to late drinks. The launch of Brightside, a roadside dining concept, shows its ambition to disrupt the service station market dominated by fast food.

The Ivy Collection (Rank 23) Richard Caring’s group has redefined “accessible luxury.” By rolling out The Ivy brand to affluent towns (e.g., Harrogate, Oxford), it captures high spend-per-head without the costs of Central London. The operational discipline is immense, with high table turnover and consistent quality. Reports of a £1bn sale process suggest the brand is at the peak of its valuation cycle.

Wingstop UK (Rank 32) The breakout star of the decade. Wingstop has connected viscerally with Gen Z culture through music and fashion partnerships. Its sales density is phenomenal. In 2024, the UK master franchise was acquired by US private equity firm Sixth Street, valuing the business at over £400m. Revenue for the 9 months to Dec 2024 was £125m, putting it on a run rate to clear £160m.

Dishoom (Rank 35) Dishoom is an anomaly: a chain that feels like an independent. Its “Bombay Café” concept generates enormous loyalty and queues. Revenue jumped 17% to £137.1m in 2024. The company recently secured investment from L Catterton (backed by LVMH) to fund international expansion, with eyes on the US market.

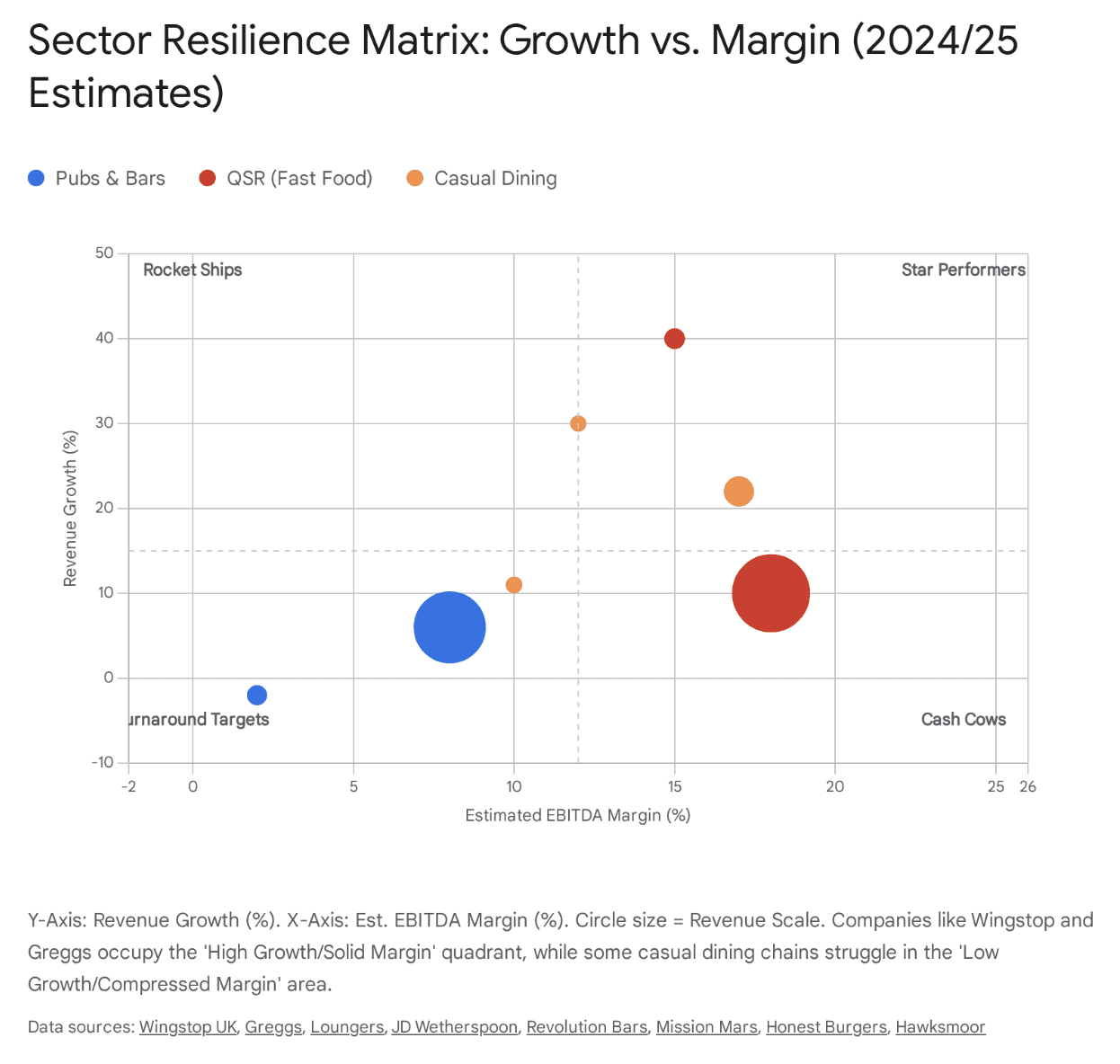

5. Competitive landscape: Resilience vs. growth

The competitive landscape is defined by the struggle to balance growth with margin protection. As illustrated in the Sector Resilience Matrix, companies like Greggs and Loungers have achieved the “holy grail” of high growth accompanied by robust margins. They achieve this through supply chain ownership (Greggs) or flexible all-day trading models (Loungers).

In contrast, the “Squeezed Middle” of casual dining (e.g., Revolution Bars, TGI Fridays/Hostmore) has struggled. These operators face a dual threat: they lack the speed/price advantage of QSRs and the “event” status of premium dining. The collapse of Hostmore served as a grim reminder that debt-laden balance sheets cannot survive in a high-interest-rate environment.

6. Key trends and outlook

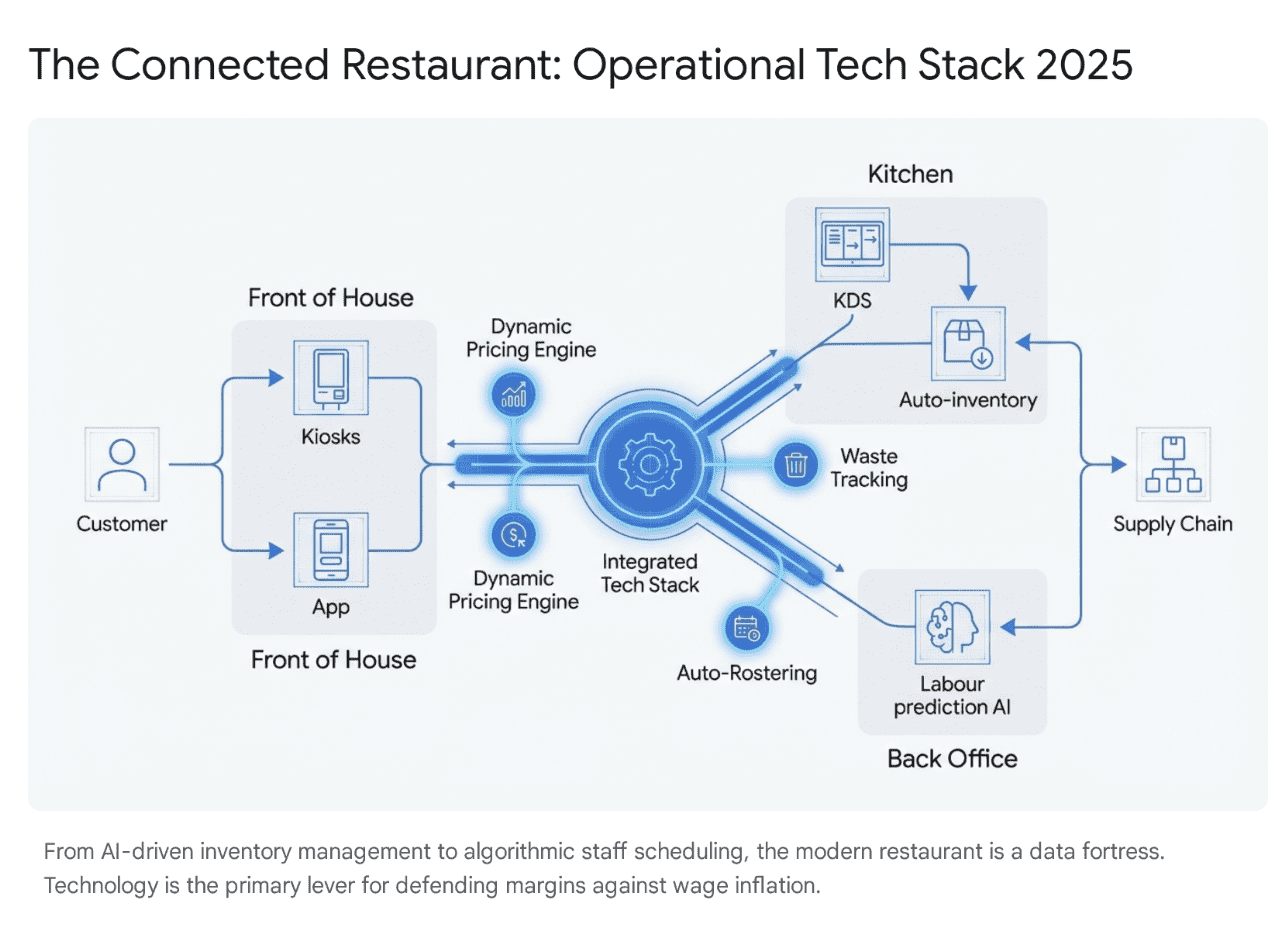

6.1 Technology: The data fortress

Technology adoption has matured from simple QR codes to sophisticated back-of-house AI.

-

Dynamic pricing: Major pub groups like Stonegate have experimented with “surge pricing” during peak times (e.g., major sporting events). While controversial, it represents a shift towards yield management similar to airlines.

-

Labour AI: Tools that predict footfall based on weather, local events, and historical data are being used by M&B to optimize staffing rosters, reducing wage waste—a critical capability given the NLW increases.

6.2 M&A: The buy-and-build playbook

The disparity between public and private valuations is driving M&A. US Private Equity is particularly active, seeing UK assets as undervalued.

-

Example: Apollo’s take-private of The Restaurant Group and Sixth Street’s purchase of Wingstop UK.

-

Outlook: Expect further consolidation in the fragmented “better burger” and “premium chicken” markets. We anticipate Cote or PizzaExpress could be targets for secondary buyouts in late 2025/26 as their current PE owners look to exit.

7. Conclusion

The UK foodservice sector in 2025 is defined by resilience and ruthlessness. The “rising tide lifts all boats” era is over. In its place is a market where scale, capitalization, and brand clarity are the only defenses against a hostile cost environment. The Top 50 ranking demonstrates that while revenue can be bought with expansion, profit must be engineered with efficiency.

I’ve added the top 50 as a table for you. Let me know if there is anything else I can help with.